By The Knoxville Roofing Company

https://theknoxvilleroofingcompany.com

If a recent Knoxville storm just tore a few shingles from your roof—or worse—you might be asking, “Will my homeowner’s insurance cover this?” The short answer? Often yes, but the claim process can be tricky if you’re not prepared.

At The Knoxville Roofing Company, we’ve helped hundreds of East Tennessee homeowners navigate insurance claims successfully. This guide walks you through everything you need to know—from spotting damage to getting your roof repaired or replaced without the stress.

1. What Types of Roof Damage Are Covered by Insurance?

Most standard homeowners’ insurance policies cover “sudden and accidental” damage—not gradual wear and tear.

✅ Typically Covered by Home Insurance:

- Wind or hail damage (common in Knoxville storms)

- Fallen tree limbs

- Fire or lightning strikes

- Vandalism or unexpected accidents

🚫 Typically NOT Covered by Home Insurance:

- Age-related deterioration

- Mold or rot due to neglected maintenance

- Improper installation or prior unreported damage

If your roof is well-maintained and the damage is storm-related, there’s a good chance your policy will cover it.

2. Step-by-Step: Filing a Roof Insurance Claim in Knoxville

Step 1: Check for Obvious Damage

After a storm, look for:

- Missing, cracked, or curled shingles

- Debris on the roof or in the gutters

- Water stains on your ceiling or attic floor

- Granules in the downspouts or driveway

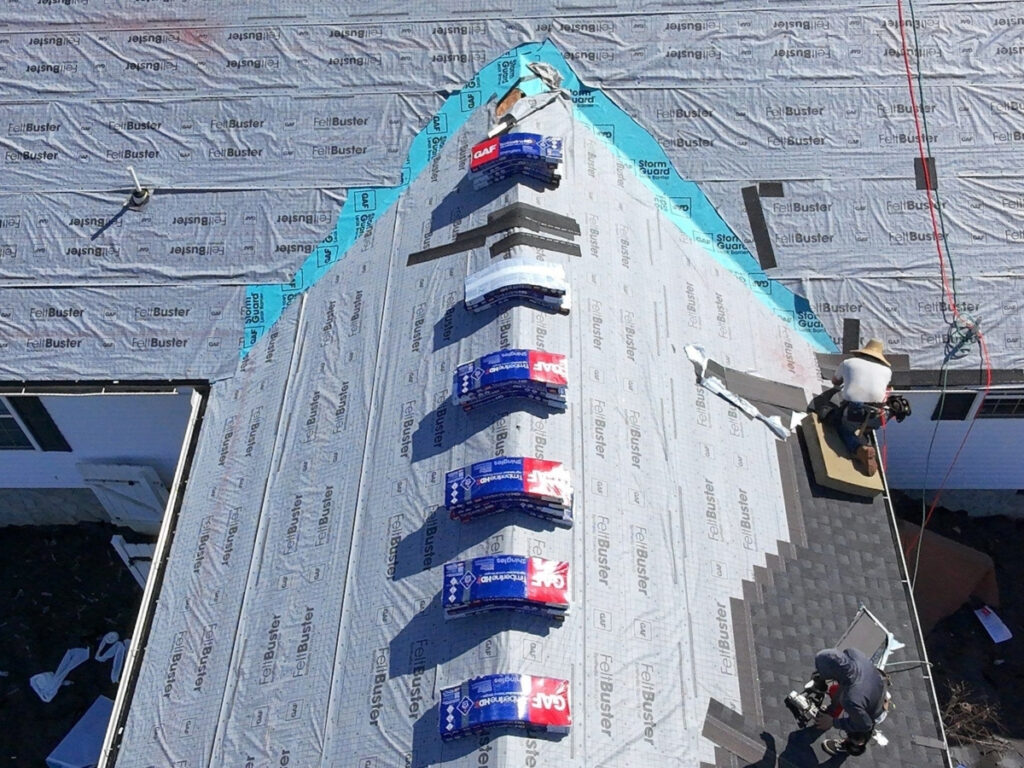

Step 2: Schedule a Professional Roof Inspection

Before calling your insurance company, have a licensed Knoxville roofer inspect the damage. This helps:

- Verify whether it’s claim-worthy

- Document everything with photos

- Create an initial estimate

At The Knoxville Roofing Company, we offer free storm damage inspections and can be on-site fast after severe weather.

Step 3: File Your Insurance Claim

Once you confirm the damage:

- Contact your insurance company (check your policy for preferred method)

- Provide basic info: date of loss, description of damage, photos

- Ask when an adjuster will be scheduled to inspect the damage

Step 4: Meet with the Insurance Adjuster

Your insurance company will send an adjuster to assess the damage. It’s ideal to have your roofing contractor present during this visit to:

- Ensure nothing is overlooked

- Explain technical findings

- Advocate for the necessary scope of work

Step 5: Receive Your Claim Estimate and Settlement Offer

Once the adjuster files their report, your insurer will:

- Send you a loss summary and payment estimate

- May issue an initial check based on ACV (Actual Cash Value)

- Hold back the depreciation until repairs are complete

Step 6: Start Repairs with a Trusted Local Roofer

Select a Knoxville roofing contractor who:

- Is licensed, bonded, and insured

- Has experience working with insurance claims

- Provides detailed documentation and invoicing to submit for final payout

3. ACV vs. RCV: What Do These Insurance Terms Mean?

It’s easy to get lost in the alphabet soup of insurance documents. Here’s a quick breakdown:

- ACV (Actual Cash Value):

What your roof is worth today, factoring in depreciation due to age and wear. - RCV (Replacement Cost Value):

What it would cost to replace your roof with new materials at today’s prices.

If your policy is RCV-based, you’ll likely receive two payments:

- Initial payment: Based on ACV

- Final payment (depreciation): After the roof is repaired and proof is submitted

Make sure you know what kind of coverage your policy includes before you file a claim.

4. Common Mistakes Knoxville Homeowners Make During the Claims Process

Avoiding these missteps can save you time, money, and frustration:

❌ Filing a claim before confirming damage

❌ Not having your roofer present during the adjuster visit

❌ Accepting a low estimate without review

❌ Using unlicensed or “storm-chasing” contractors

❌ Ignoring small damage until it becomes an emergency

Pro tip: Don’t wait for damage to become visible inside. Preventative inspections after major weather events can catch issues early and build a paper trail.

5. Why Choose a Local Roofing Partner for Insurance Work?

Working with a trusted Knoxville roofer (like us!) gives you:

- Faster response times after storms

- Accurate, local pricing and material knowledge

- Familiarity with Tennessee insurance carriers and claim trends

- Peace of mind that you’re not getting scammed by out-of-state “storm chasers”

At The Knoxville Roofing Company, we’ve helped dozens of homeowners recover storm damage funds they didn’t even know they were entitled to.

6. FAQs: Roof Insurance Claims in Knoxville

Q: How long do I have to file a claim after storm damage?

A: Most Tennessee policies allow 1 year—but some may be shorter. File as soon as possible after the damage.

Q: Will my rates go up if I file a roof claim?

A: Possibly, but not always. Rate increases are more likely with multiple claims or if damage is due to neglect.

Q: Can I choose my own contractor?

A: Yes! You’re not required to use the insurance company’s “preferred vendor.” Choose a roofer you trust.

Q: What if the insurance payout is too low?

A: Your roofer can help submit a supplement with documentation to request more.

You Don’t Have To Do It Alone

Filing a roof insurance claim doesn’t have to be a battle—but it does require experience, documentation, and a contractor who knows the system.

If you’ve recently had storm damage—or even just suspect it—don’t wait. The sooner you act, the smoother the process.

🔍 Schedule your free inspection today with The Knoxville Roofing Company.

📄 We’ll document the damage, guide you through the claim, and handle your repairs with integrity.